To exchange foreign currencies, you will need to have an active Chase Bank account in good standing. Foreign currency exchange is available for all Chase Bank customers. Does Chase Bank offer foreign currency exchange and what is the Chase Bank currency exchange rate are some commonly asked questions regarding Chase Bank’s foreign currency exchange.

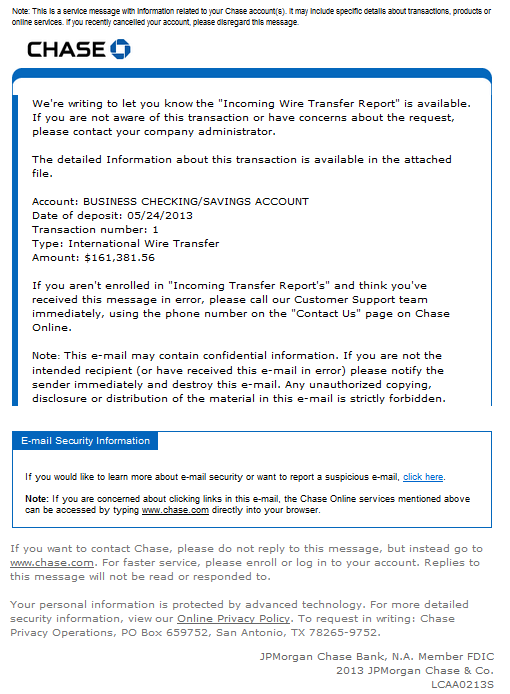

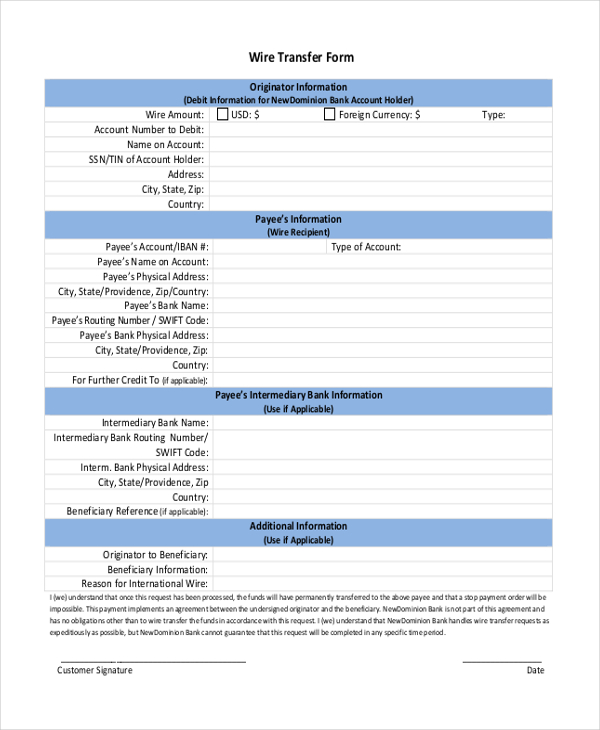

However, like most banks, Chase sells foreign currency to customers with a margin added onto the exchange rate. Chase Bank buys and sells foreign currency at the mid-market exchange rate in the foreign exchange market, which is the exchange rate you’ll find on any given day via Google or Reuters. Whether you need to send money around the corner or around the world, we make it easy and reliable to transfer money to your loved ones’ bank accounts. To receive wire transfers in your Chase Bank account, you must provide the following bank and account information to the transferring financial institution. Chase Bank has more than 4,700 branches and over 16,000 ATMs across the US.Ĭhase, for instance, charges $35 for domestic wire transfers set up for you by a banker and $25 for the same transfer if you do it yourself online. Once your wire transfer is made, please send an e-mail notice to your account manager. Note that the fees shown in the table above are reflective of transfers made in person at a branch and outgoing transfers sent in U.S. Some banks - including Bank of America, Wells Fargo, Chase Bank and Capital One - will charge $5-$10 more if transfers are made in a different currency. But, be prepared for it to take up to 24 hours, especially if you’re wiring funds internationally. Generally, a wire transfer can take just a few minutes to complete. When wire transfers are cheaper elsewhereĭomestically, the cheapest way to wire money is pretty straightforward - it’s usually a flat rate regardless of the amount transferred. Fees for wire transfers initiated in mobile and online banking will be displayed before confirmation. Here’s a closer look at the process along with four of the best ways to electronically move money to foreign countries. Before wiring money abroad, it’s a good idea to understand how international money transfers work. Where a domestic money transfer usually takes a few minutes, an international money transfer - also known as a “remittance” - may take a few days or sometimes longer. The amount of time it takes to wire money abroad depends on where it’s being sent. That doesn’t even include the FX rates, fees charged by other banks that touch your transfer, and other gouges they aren’t telling you about. Even if you send money within the US, you’ll be charged $35. More often than not, more will be taken off the top of an international transfer than is expected out of the exchange. This shouldn’t be a surprise at this point, but different banks will charge different foreign exchange rates. If you’re transferring money to an account in Europe that does use IBAN, you can usually find it by visiting their website or asking the recipient for the number. The US doesn’t currently participate in IBAN, which means no American bank will provide you with an IBAN code.

#Wire transfer chase code

Some wire transfers might ask for an IBAN, which is a set of numbers that create a code for transfer in Europe.

This is a fast and easy way to transfer money between individuals with little to no fees, but may not be as secure as wire transfers.Ĭhase frequently offers cash bonuses for new banking customers. The top mobile payment apps typically offer P2P money transfers where an individual with another person’s email address or phone number can easily send money to their account.

But wire transfer fees are also a source of revenue for banks, similar to the monthly maintenance fees charged on checking and savings accounts. Wire transfer fees exist in part because there’s a cost to send money between banks. Here is a list of the domestic and international wire transfer fees you can expect to pay. How much does it cost to wire money internationally with Chase? This is an important question to ask before choosing to send money abroad using Chase. The fee charged for this transaction is the wire transfer fee. You can send wire transfers online, over the phone, or in-person at a bank branch. Select the routing number that correctly corresponds with the region where you opened the account. The easiest way to find your routing number is to look at your checks. The following check image will show you where to look to locate routing number in your check. For other countries, the account number must be entered without spaces or hyphens.Southampton want £40m for Manchester United target Kyle Walker-Peters – Paper Talk. Southampton want £40m for Manchester United target Kyle Walker-Peters – Paper Talk – Sky Sports

0 kommentar(er)

0 kommentar(er)